Yes, the Puget Sound real estate market is slowing down. You can feel it. After years of a market that was moving much faster than it is today, the headlines are confusing, and the future feels uncertain. But here is the good news: it’s not crashing.

The market’s response to the pressures of 2025 is not a collapse; it is a rebalancing.

For buyers and sellers, this shift can cause uncertainty and anxiety. The market is shifting and the strategies that worked in the past may not work going today. So, how do you move forward with confidence?

You need a guide with a clear plan. Our team is here to help.

First, let's clear up the confusion by identifying the three simple forces causing this slowdown.

Tech is Restructuring, Not Collapsing

The tech layoffs are real. People are losing their jobs (we know several who have), and if you are one of those people, we are truly sorry.

But it’s crucial to separate the headlines from the data. The Puget Sound region is simultaneously cementing its role as a global hub for AI talent, which is expected to fuel the next wave of job growth.

To understand the real-time impact, we look at the official data from the Washington State Employment Security Department (ESD) WARN database:

Amazon: Following the announcement of 14,000 global corporate cuts, the official WARN filing confirmed 2,303 employees in Washington, primarily in Seattle and Bellevue.

Microsoft: The company has reduced its Washington state workforce by over 3,200 jobs since May 2025, part of more than 15,000 job cuts globally.

Salesforce: A recent WARN notice detailed 93 affected employees in Seattle and Bellevue.

The "Affordability Lock" (Interest Rates)

The second headwind is the "affordability lock." While rates have dipped from their peaks, they remain high enough to dissuade both buyers and sellers.

This creates two problems:

The "Golden Handcuff": Existing owners with low rates from years past are reluctant to move up, keeping inventory tight.

The Renter Trap: High borrowing costs are sidelining would-be buyers, trapping them in the rental market.

We don’t anticipate rates dropping significantly, so buyers need to get comfortable with rates around 6%. The good news? This pause may bring prices down a bit, making homes more affordable in this new environment.

The Seasonal Amplifier

The data clearly shows that our market always has a seasonal slowdown in Q4. With the holidays around the corner and as the rain starts and the days become darker, house hunting is naturally put on hold.

This year, that normal seasonal cooling, combined with the tech and interest rate headwinds, is simply amplifying the market's deceleration. And yet, last week we had two of our listings receive multiple offers. This proves that in real estate, markets are hyper-local, and there are always outliers.

How to Win in a Rebalanced Market

The new market reality requires a shift in strategy.

A Plan for Sellers: "Price to the Market, Not to the Past."

The days of looking back 3-6 months to price your home are over. It’s never been more important to prepare your home for sale and price it for today’s market.

The strategy is to price correctly from day one to avoid chasing the market down. This is now a "beauty contest", and only turnkey properties that are priced competitively will move quickly.

Overpricing your home, can lead to it languishing on the market and suffering multiple price cuts. But a successful sale is still achievable if you treat your listing like a product to be launched, not just a property to be sold.

A Plan for Buyers: "The Return of Due Diligence."

If you've been beaten down by the fast-paced market, this may be the best opportunity we’ve seen in the past 5 years.

As the market slows and some sellers get frustrated, you have the luxury of time. You can look at several homes, negotiate on price, and finally have the opportunity to do your own inspections and due diligence.

Don’t be paralyzed by headlines and sit on the sidelines, missing the best buyer's opportunity in years. You CAN do this and buy a home with confidence, negotiation power, and peace of mind.

The Data: The Tool That Gives Us Clarity

So, how did we come to this conclusion? We use real-time data as our guide.

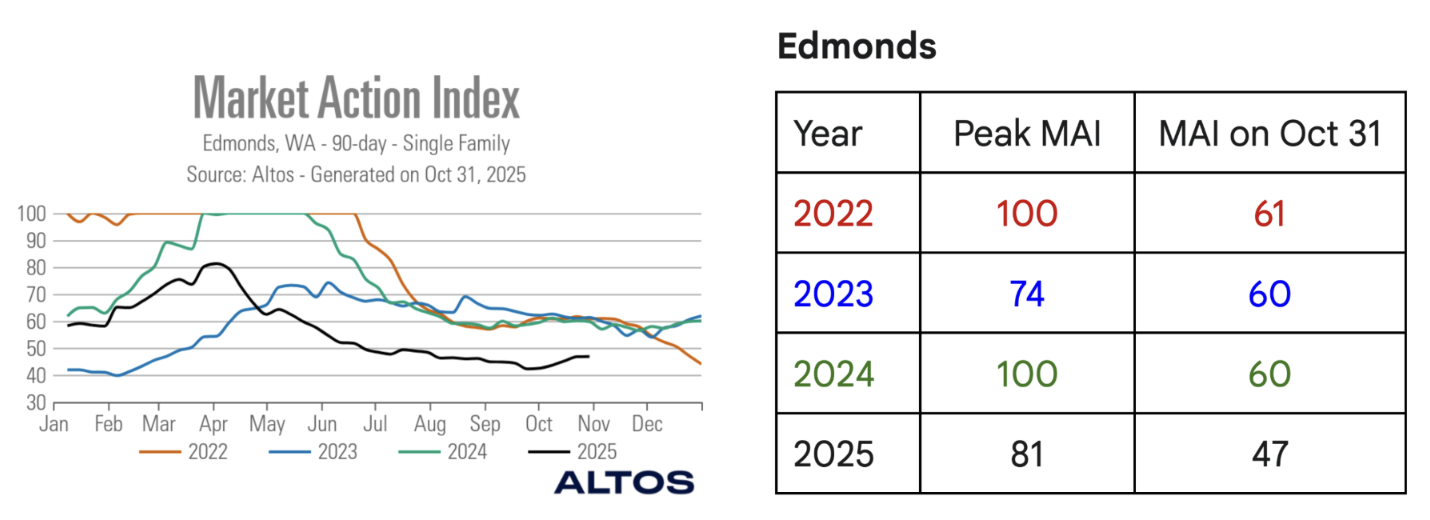

The Market Action Index (MAI) is the most important number we use. It answers the question, “How’s the market?” in one simple number by comparing the rate of sales to the amount of inventory.

A number above 30 still indicates a market that favors sellers.

A number below 30 indicates a buyer's market.

While the number is important, the trend line is the real story as it tells us where the market is going.

Look at the data for our four key cities. You can see the fast-moving peaks of past years compared to the "rebalancing" we see today. Notice that while the MAI is dropping, all four cities are still technically in a Seller's Market (above 30)—this is why it's a rebalancing, not a crash.

Ultimately, the story of Q4 2025 is not a crash, but a rebalancing. After years of a market moving at an unsustainable pace, the market is returning to a more normal, healthy cycle.

This shift creates clarity: sellers must adapt to the new reality with smart pricing, and buyers have the best opportunity in years to negotiate and perform due diligence. The long-term fundamentals of the Puget Sound, particularly its future as a global AI hub, remain incredibly strong. This is a market of strategy, not speculation, and we are here to help you navigate it.