Every January, the same question echoes through our inboxes, dinner tables, and soccer sidelines:

"So… what do you think is going to happen with the market this year?"

This year, instead of piecing together headlines and hot takes, we have something better: a comprehensive 67-page market outlook from Compass Intelligence. We've read it cover to cover so you don't have to. Here's what it means for you.

The Fog Is Finally Lifting

After four years of pandemic-driven chaos (frozen migration, wild mortgage rate swings, and record-breaking price increases followed by stubborn stagnation) it's understandable that you're confused. The media isn't helping. One headline screams "crash incoming," the next whispers "prices still rising."

You're not crazy. The signals really are mixed.

But here's the good news: data is the antidote to fear. And the data for 2026 is surprisingly clear.

“2026 marks the beginning of a new era, one defined by stability, not dramatic swings. ”

The pandemic distortions are finally unwinding. Mobility is slowly improving. Inventory is normalizing. And both buyers and sellers are recalibrating expectations after years of scarcity and shock.

The Numbers That Matter

Here are the four key forecasts from the Compass 2026 Housing Market Outlook:

Home Prices: Essentially Flat (+0.5%)

National prices are expected to hold steady with a realistic range from -3.6% to +4.6%. This is neither a crash nor a boom. Many metros are already posting year-over-year declines, but strong household balance sheets prevent significant downside.

Mortgage Rates: Trading Between 5.9% and 6.9%

The year's average should land around 6.4%—about 0.4 percentage points lower than 2025. The labor market will determine the direction: rising unemployment could pull rates into the high 5s, while hot inflation could push them back toward 7%.

Inventory: Up About 10%

Supply continues to grow, which is good news for buyers. Expect inventory to top 1 million single-family listings for the first time since 2017 during peak summer months.

Home Sales: Modest Growth (~5%)

Existing home sales across the country should rise from 4.1 million to approximately 4.25 million. If conditions align just right—what the report calls a "Goldilocks scenario"—sales could reach 4.5 million, a strong 10% growth rate.

If You're Thinking About Buying

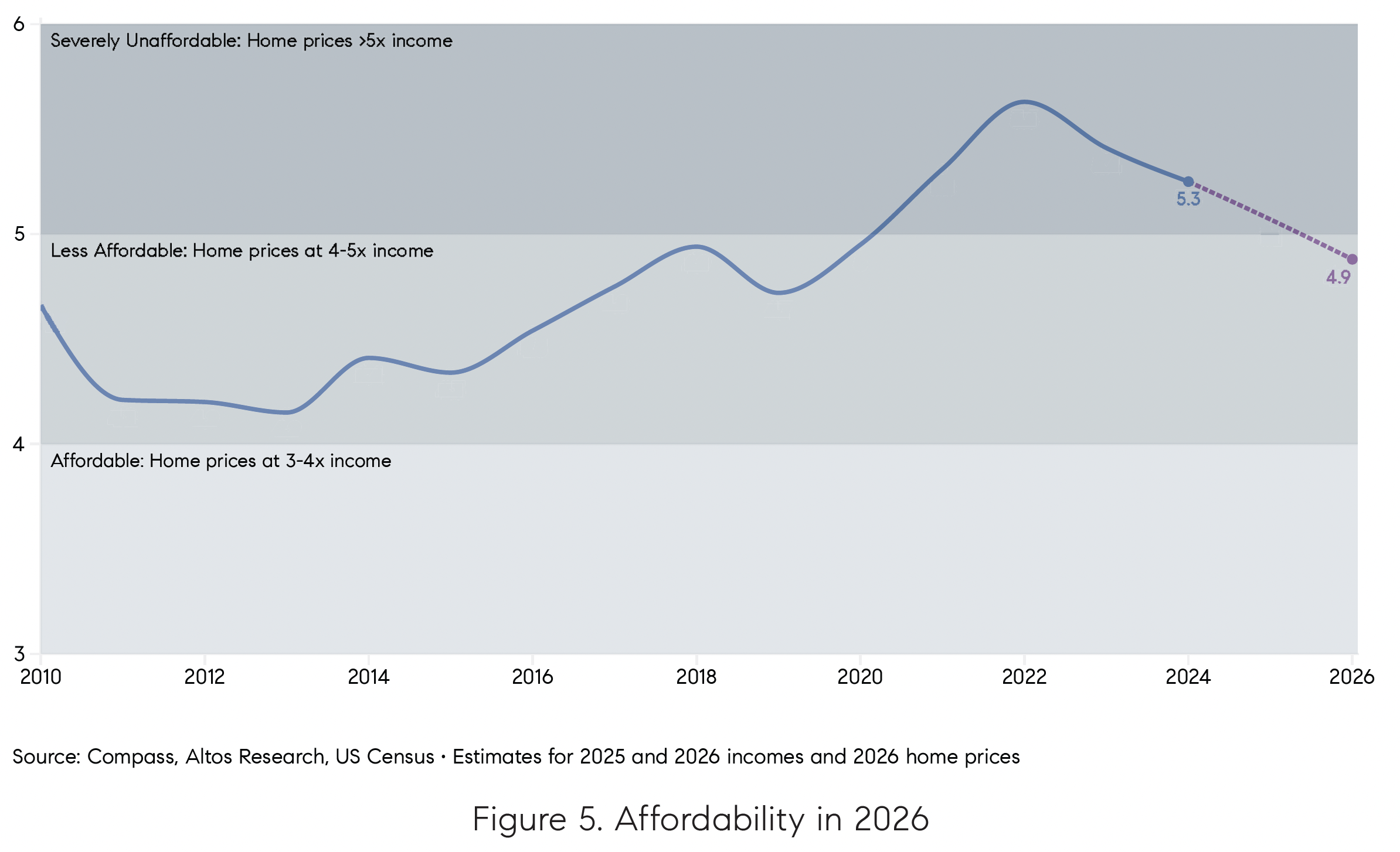

The report shows that housing affordability hit its worst level in nearly 40 years by late 2022. The path back to normal isn't a dramatic price correction. It's an extended period of flat home prices combined with rising incomes.

“If you’ve been sitting on the sidelines waiting for the perfect moment, here’s the reality: affordability is improving, but it’s happening gradually, not through a crash.”

At 4% annual income growth (roughly the current pace), affordability returns to traditional levels within several years—even if mortgage rates never drop significantly. And if rates do fall? The timeline accelerates.

Affordability Improves in 2026: Price-to-income ratio is improving as incomes climb faster than home prices.

You're not going to wake up to 2008-style deals. But you will have more selection, more negotiating power, and better conditions than at any point since 2021.

If You're Thinking About Selling

In a flat-price environment, pricing strategy matters more than ever.

The report reveals that roughly 42% of active listings nationally have taken a price cut—one of the highest late-year readings in more than a decade. That's not a sign of a crash. It's a sign that sellers who price correctly from day one are winning, and those who don't are sitting.

Sound familiar? We've been saying this for two years now: the disconnect between buyer expectations and seller expectations creates opportunity for those who understand the data.

“If you’re priced right and your home shows well, buyers are ready. Weekly pending contracts are at their highest Q4 levels since 2021. But “hope pricing” will cost you time and money.”

Location Still Matters… A Lot

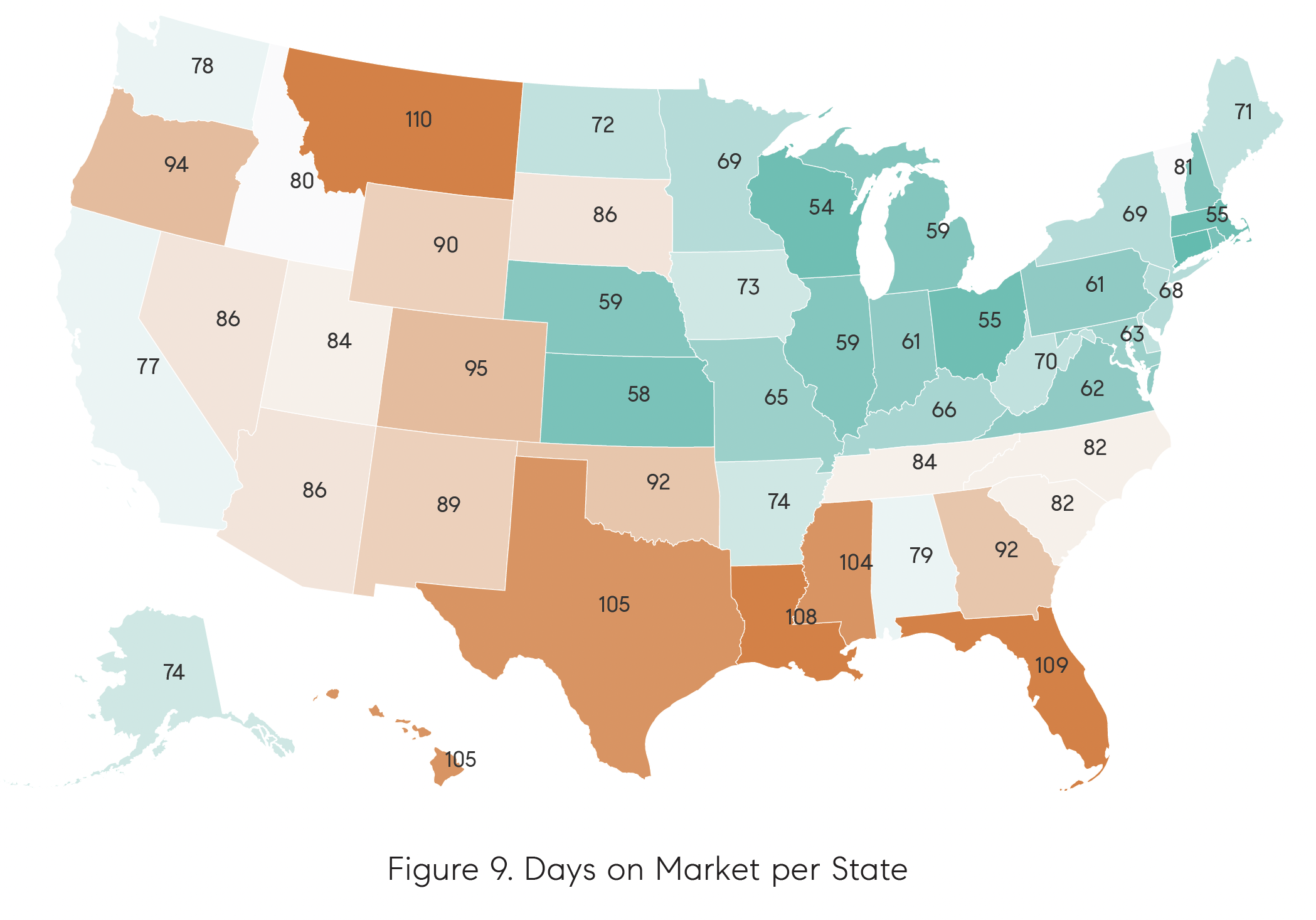

The report highlights a key dynamic we've been watching: regional differences are more pronounced than ever.

Blue states in the North have fast-moving markets with scarce inventory. Orange states in the South have slower markets with more selection.

In the Northeast and Midwest, homeowners who would traditionally sell and move south have stayed put. The result? Extremely tight inventory. Connecticut has 60% fewer homes on the market than in 2019.

In the Sun Belt, the opposite happened. Inventory swelled as the expected wave of buyers never arrived. Texas now has 50% more homes for sale than in 2019.

For our Pacific Northwest market: Washington shows 82 average days on market—right in the middle. We're not as tight as the Northeast, but we're nowhere near the oversupply of Texas and Florida. This balanced position means strategy matters. Whether you're buying or selling, understanding where your specific neighborhood sits on this spectrum is everything.

The Thaw Is Coming

One of the most interesting insights from the report is what they call "The Great Stay"—the phenomenon of Americans staying put in their jobs, their towns, and their houses since 2022.

This happened because of mortgage rate lock-in. When you have a 3% mortgage and today's rates are near 7%, trading up becomes financially painful. Millions of homeowners chose to stay frozen in place.

“But here’s what’s changing: Nearly 20% of mortgages now carry rates above 6%. That share grows with every new home sale. These homeowners aren’t anchored to a rate they’ll never see again. They’re free to move when life demands it.”

Expect slightly higher transaction volume in 2026 as lock-in continues to fade. This won't unleash a flood of inventory, but it removes one of the key constraints that has kept the market frozen.

Where We Go From Here

You're standing at the beginning of a new era in real estate. The pandemic chaos is behind us. The path ahead isn't perfectly clear, but it's clearer than it's been in years.

If you're buying: More selection, more negotiating power, and gradually improving affordability. Don't wait for a crash that isn't coming, but do work with someone who understands the nuances of your specific market.

If you're selling: Price realistically from day one. Prepare your home well. Buyers are active—they're just more selective than they were in 2021.

If you're planning ahead: The next few years will bring continued normalization. Affordability will slowly improve. Mobility will increase. The frozen market is thawing.

Want the Full Picture?

This blog barely scratches the surface of the Compass 2026 Housing Market Outlook. The full report includes detailed forecasts for every state, deep dives into regional dynamics, and analysis of economic scenarios that could shift the market in either direction.

Download the Full 2026 Housing Market Outlook Report (PDF)

Let's Talk About Your 2026

Whether you're thinking about buying, selling, or just trying to understand what's happening in your neighborhood, we're here to help you cut through the noise.

Have questions about what 2026 looks like for your specific situation? Reach out anytime.

Note: Data and forecasts are from the Compass 2026 Housing Market Outlook. This report is for informational purposes only and is not intended as financial, legal, or real estate advice. Market forecasts are speculative and subject to change.